41+ how to calculate marital portion of 401k

The PERA member is age 55 and the former spouse is age 53. 18 years of service credit earned while married.

The Iola Register June 11 2020 By Iola Register Issuu

The calculation should have been 35 months divided.

. If an individual was employed by her firm for five years prior to the marriage and was married for ten years. Web Thus 50 percent 10 years 20 years 50 percent of the total service is the marital portion. Web One needs to follow the below steps to calculate the maturity amount for the 401 Contribution account.

Step 1 Determine the initial balance of the account if any. Web A 401 k plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the. Web A division of individual retirement accounts IRAs can be ordered in a divorce decree or a property settlement agreement thats been recognized by the court.

Current 401 k Balance. For example if you were married for 4 years and you added to your 401 k. Web If the nonmarital portion is 25000 at the beginning of the year it grows to 2789150 at the end of the year and the marital portion is the difference between the.

Web According to research from Transamerica this is the median age at which Americans retire. Objective The primary objective of the Marital Split Calculator the Tool is to educate you about the financial impact of the division of. Web The amount accrued in the 401k between the marriage date and separation date or divorce date will be greater than the actual community property portion.

Web How to calculate employer 401k match. Web Liquidate the 401 k to pay one spouse. This is generally the least desirable approach because of taxes potential penalties and need for legal approval.

Hopefully you have more than this saved. Web Your 401 k balance at retirement is based on the factors you plug in to the calculator your total planned annual contribution your current age and retirement age and the rate. Web Marital Split Calculator Methodology 1.

Web A 401 k plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the employees wages to an. Then five years out of 15 years would be non-marital or. Web The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and.

Web The trial courts finding that appellant is entitled to 39 of appellees retirement pay is thus inaccurate. 30 ex-spouses portion NYSLRS will. 60 marital share 30 years of total service credit at retirement.

Generally employers calculate their 401k match by multiplying a percentage of each employees salary that is matched with the total. Web A portion of your retirement can be non-marital if it was put into the account before the marriage. Web If you have a defined contribution plan such as a 401k that was created before marriage the marital value of the plan the portion subject to division is the increase in value.

Web Often the marital portion of a 401 kany.

41 Free Pay Stub Templates In Google Docs Google Sheets Ms Excel Ms Word Numbers Pages Pdf

Collaborative Divorce Dividing Retirement Accounts

The Iola Register February 11 2021 By Iola Register Issuu

Wz Hcta 11 20 By Randal Seyler Issuu

Bill Organization Get Some Much More With These 2 Money Systems

Irn300317a01 By Iola Register Issuu

:max_bytes(150000):strip_icc()/how-to-divide-assets-in-a-divorce-7092228-2c390a3742884e39a3d0e062f2a2554f.jpg)

How Retirement Plan Assets Are Divided In A Divorce

Why Employers Should Help Employees Understand The Benefits Of Roth 401 K S Employee Benefit News

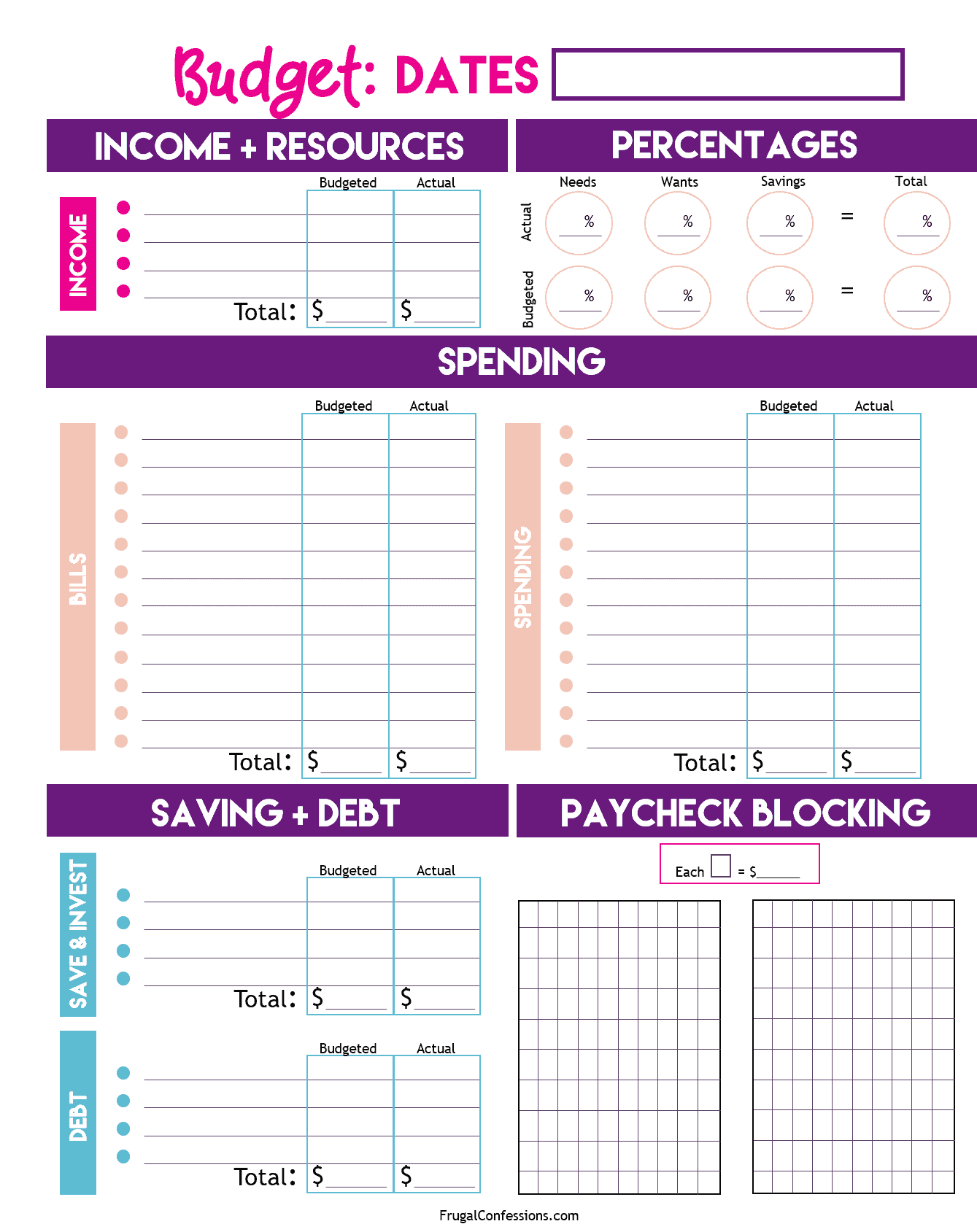

How To Fill Out A Budget Sheet Simple Tutorial With Paycheck Blocking

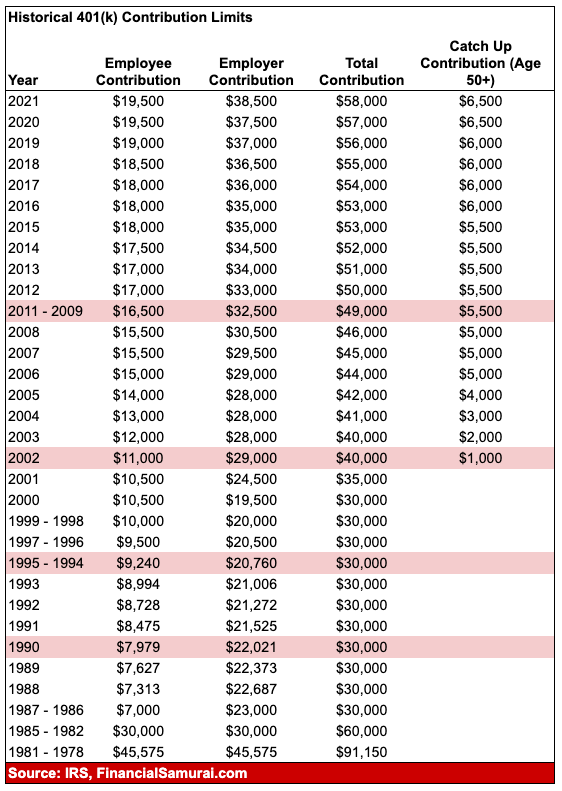

401k Maximum Contribution Limit Finally Increases For 2019

The Iola Register January 12 2021 By Iola Register Issuu

Retirement Plan Division The Details

401 K Maximum Employee Contribution Limit 2023 22 500

4 Things To Know About Splitting Up A 401 K In A Divorce Smartasset

Irn040317a01 By Iola Register Issuu

Bill Organization Get Some Much More With These 2 Money Systems

How Are 401 K S Typically Split During A Divorce